Vishal Mega Mart IPO GMP and Review is currently the talk of the market as the IPO opens for subscription from 11 December 2024 to 13 December 2024, with a price band of ₹74-₹78 per share. The offering aims to raise ₹8,000 crore through an Offer for Sale (OFS).

With a Grey Market Premium (GMP) of ₹14, the IPO reflects positive investor sentiment, bolstered by Vishal Mega Mart’s extensive retail network and strong market position. This article focuses on the Vishal Mega Mart IPO GMP and Review, providing an in-depth analysis of key details, quota allocations, and financial insights to assist investors in making well-informed decisions.

| Details | Information |

|---|---|

| IPO Price Band | ₹74 – ₹78 per share |

| Lot Size | 190 shares |

| Minimum Investment | ₹14,820 |

| IPO Type | Book Building (Offer for Sale) |

| Issue Size | ₹8,000 crore |

| Market Listing | BSE, NSE |

| Quota Allocation |

|

| Important Dates |

|

Vishal Mega Mart IPO GMP and Review

The Grey Market Premium (GMP) for this IPO currently stands at ₹14, indicating that investors have a positive outlook on its potential listing performance. While GMP provides an idea of demand, remember that it is not a guarantee of listing gains.

Company Overview and Operating Model

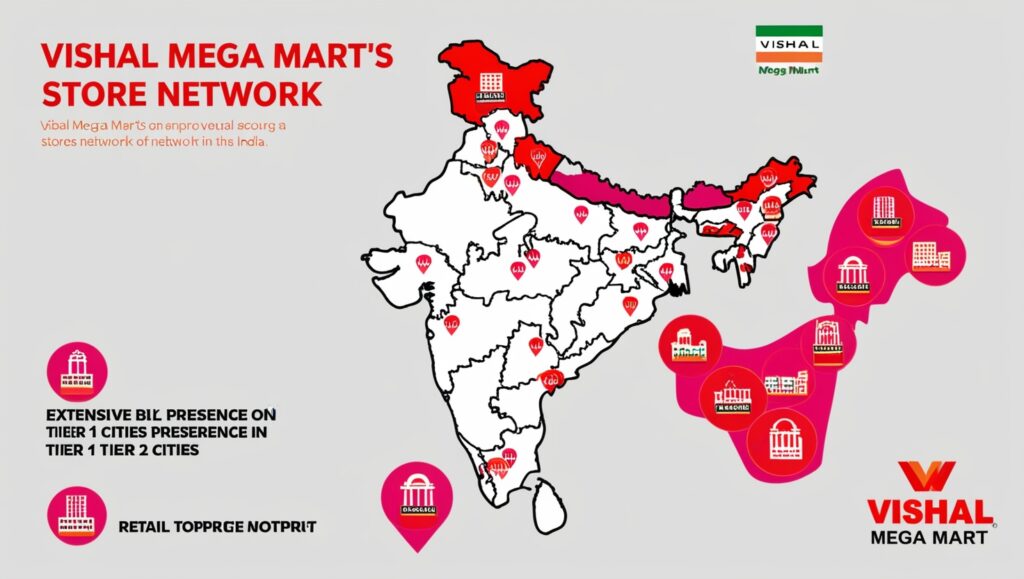

Vishal Mega Mart is a retail giant known for its wide range of affordable products, catering to the growing middle-class population in India. As of June 2024, the company operates 626 stores across 403 cities, including Tier 1 and Tier 2 areas. Its product lineup covers apparel, general merchandise, and FMCG, backed by strong private-label brands. The company’s strategy revolves around offering value-for-money products, attracting a loyal customer base.

Financial Performance

The company has shown robust financial growth over recent years. In FY2024, 19 of its private-label brands recorded sales above ₹1,000 million, with six surpassing ₹5,000 million. Despite earlier challenges with negative cash flows, recent numbers suggest improved profitability, signaling the company is on a stronger financial footing.

Key Strengths and Risks

Strengths

- A vast network of stores across India.

- A strong lineup of successful in-house brands.

- Solid growth in revenue and expanding customer base.

- Focused on Tier 2 and Tier 3 cities, which are emerging as high-growth areas.

Risks

- Intense competition from other retail giants like DMart and Reliance Retail.

- Heavy reliance on leased properties for stores and warehouses.

- Past regulatory scrutiny could raise concerns among investors.

- Vulnerability to economic downturns, which could affect discretionary spending.

Should You Apply?

For those looking to invest in the retail sector, Vishal Mega Mart’s IPO seems promising, thanks to its extensive market presence and strong brand appeal. However, potential investors should weigh the risks, such as stiff competition and reliance on leased properties. Overall, it’s a good choice for long-term investors who believe in India’s growing retail industry.

Top 5 FAQs

- What are the Vishal Mega Mart IPO dates?

The IPO opens on 11 December 2024 and closes on 13 December 2024. - What is the price band for the IPO?

The price band is set at ₹74-₹78 per share. - How much do I need to invest?

The minimum investment amount is ₹14,820 for one lot of 190 shares. - What is the Grey Market Premium today?

The current GMP is ₹14. - Is it worth applying for this IPO?

It could be a great investment for long-term growth, especially if you’re bullish on India’s retail sector. However, consider the associated risks