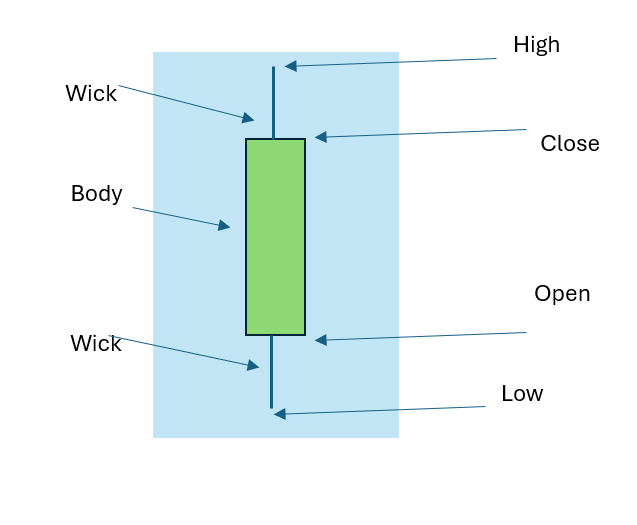

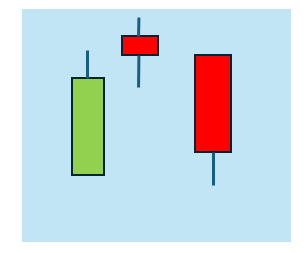

Price chart used in technical analysis that displays the high, low, open, and close prices of an asset (such as stocks, commodities, or cryptocurrencies) for a specific time period. It is called a candlestick patterns chart because each time interval (e.g., day, hour) is represented by a rectangular “candle” with a wick or shadow extending above and/or below it.

| Structure of a Candlestick |

| Single Candlestick Patterns |

| Dual Candlestick Patterns |

| Three Candlestick Pattern |

Structure of a Candlestick:

- Body: The rectangular part of the candlestick shows the opening and closing prices.

- Bullish candle (typically green or white): If the closing price is higher than the opening price.

- Bearish candle (typically red or black): If the closing price is lower than the opening price.

- Wicks (or Shadows): Thin lines extending above or below the body, indicating the highest and lowest prices within that period.

- Upper shadow: Shows the highest price reached.

- Lower shadow: Shows the lowest price reached.

Single Candlestick Patterns

Candlestick patterns are essential tools in technical analysis, helping traders understand market sentiment and predict potential price movements. Among the various candlestick patterns, single candlestick formations provide quick insights into market trends. Here’s a look at some key single candlestick patterns and their significance:

1. Doji: The Indecision Marker

The Doji candlestick pattern forms when the opening and closing prices are very close or identical, resulting in a candle with a small or non-existent body. This pattern indicates indecision in the market, where neither buyers nor sellers have the upper hand. Dojis often appear before significant price reversals or trend continuations.

2. Hammer: The Bullish Reversal Signal

The Hammer is a bullish reversal pattern that typically forms after a downtrend. It has a small body at the upper end of the trading range with a long lower shadow, signaling that buyers have managed to push prices back up after an initial sell-off. This pattern suggests a potential upward reversal in price.

3. Inverted Hammer: Early Bullish Signal

The Inverted Hammer is similar to the Hammer but appears after a downtrend and has a long upper shadow and a small body. It signals that buyers are beginning to gain control, although the market may still be indecisive. Like the Hammer, it can suggest a bullish reversal, with a stronger confirmation needed in the next sessions.

4. Shooting Star: Bearish Reversal Signal

The Shooting Star is a bearish reversal pattern that appears after an uptrend. It has a small body at the lower end of the trading range and a long upper shadow. This suggests that buyers pushed the price higher, but sellers stepped in, causing the price to close near its open. The Shooting Star often indicates a potential downtrend

5. Spinning Top: Indecision in the Market

The Spinning Top candlestick pattern has a small body and long upper and lower shadows, showing that both buyers and sellers were active, but neither side gained significant ground. Like the Doji, it signifies indecision and often appears before a reversal or consolidation phase.

6. Marubozu: Trend Continuation

The Marubozu is a strong trend indicator with no shadows. It is a full-bodied candlestick where the price opens at one extreme and closes at the other, indicating strong momentum in the direction of the trend. A bullish Marubozu suggests continued upward momentum, while a bearish Marubozu indicates strong selling pressure.

Dual Candlestick Patterns

Dual candlestick patterns consist of two candles that work together to indicate possible trend reversals or continuations in the market. These patterns provide a clearer signal than single candlesticks, offering more confirmation of market sentiment. Below is a brief overview of some common dual candlestick patterns:

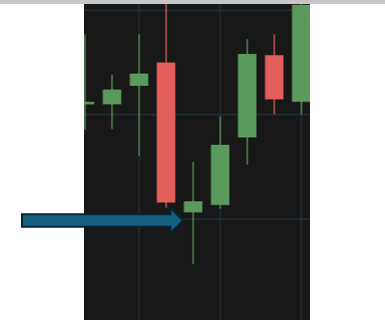

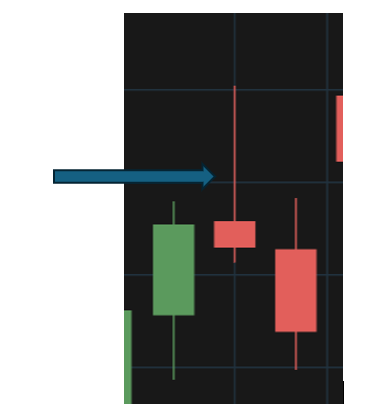

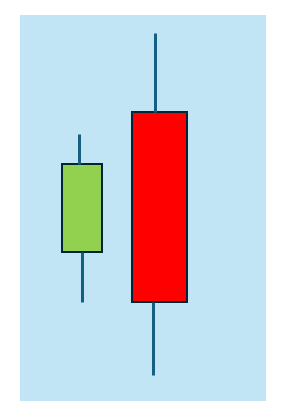

1. Bullish Engulfing: Strong Upward Reversal

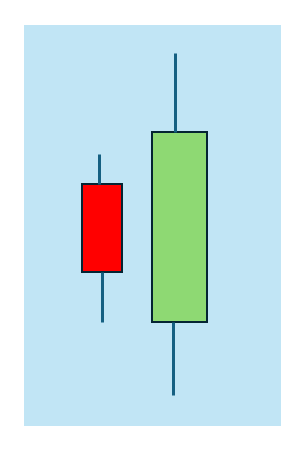

A Bullish Engulfing pattern forms when a larger bullish (green or white) candlestick completely engulfs the body of a smaller bearish (red or black) candlestick from the previous period. This pattern typically appears after a downtrend and signals potential upward movement. It shows that buyers have taken control of the market, pushing the price higher after a period of selling pressure.

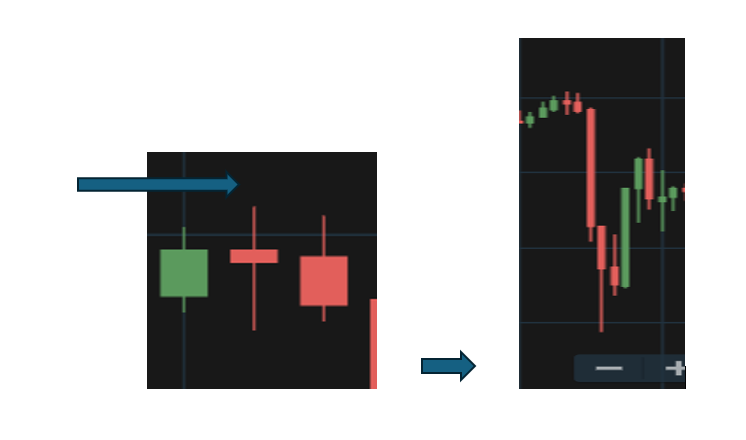

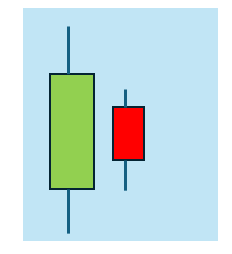

2. Bearish Engulfing: Warning of a Downturn

The Bearish Engulfing pattern is the opposite of the bullish version. It occurs when a larger bearish candlestick engulfs the body of a smaller bullish candlestick, indicating potential downward movement. This pattern often appears after an uptrend, signaling that sellers are beginning to take control and a price decline may follow.

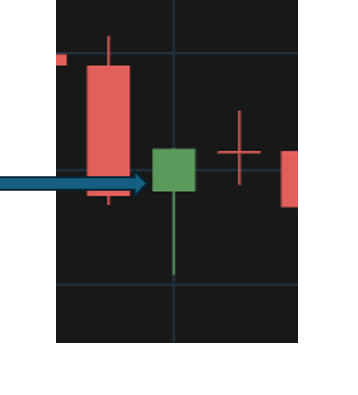

3. Harami: Indecision Leading to Reversal

The Harami pattern consists of a small candlestick contained within the range of a larger candlestick from the previous period. The large candle reflects strong market sentiment, while the smaller candle indicates indecision or a potential reversal.

- Bullish Harami: Appears after a downtrend, where a small bullish candle forms within the range of a larger bearish candle, signaling a potential upward reversal.

Bearish Harami: Appears after an uptrend, where a small bearish candle forms within the range of a larger bullish candle, signaling potential downward movement

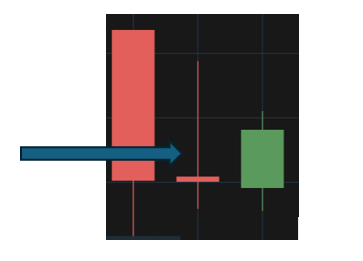

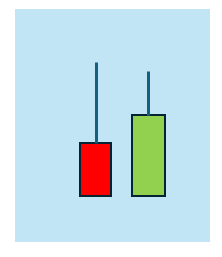

4. Tweezer Tops and Bottoms: Perfect Reversal Indicators

Tweezer patterns involve two candles with matching highs or lows, which indicate a potential market reversal.

- Tweezer Tops: This bearish reversal pattern occurs after an uptrend when two candles form with nearly identical highs. It suggests that the price has reached resistance and may start to decline.

Tweezer Bottoms: A bullish reversal pattern that appears after a downtrend. It consists of two candles with matching lows, signaling that the price has found support and may begin to rise.

Three Candlestick Pattern

Three candlestick patterns are commonly used in technical analysis to predict potential reversals or continuations in market trends. Here are three well-known three-candle patterns:

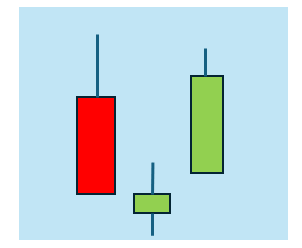

1. Morning Star

- Type: Bullish Reversal

- Description: The Morning Star pattern signals a potential reversal from a downtrend to an uptrend. It consists of:

- First Candle: A large bearish (red) candle indicating strong selling pressure.

- Second Candle: A small candle, either bullish (green) or bearish (red), which could be a doji or spinning top, reflecting market indecision.

- Third Candle: A large bullish (green) candle, indicating that buyers are stepping back in and that the market may start trending upward.

- Interpretation: The small second candle shows that the selling momentum is weakening, and the large third candle confirms the start of a potential uptrend.

2. Evening Star

- Type: Bearish Reversal

- Description: The Evening Star pattern signals a potential reversal from an uptrend to a downtrend. It consists of:

- First Candle: A large bullish (green) candle, showing strong buying momentum.

- Second Candle: A small candle, either bullish or bearish, indicating indecision or a loss of momentum.

- Third Candle: A large bearish (red) candle, indicating that selling pressure is taking over and a downward trend may be starting.

- Interpretation: The small second candle suggests the weakening of buying power, and the large bearish third candle confirms the potential shift to a downtrend.

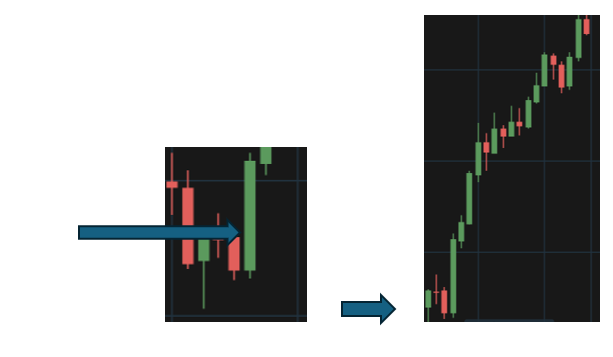

3. Three White Soldiers

- Type: Bullish Continuation/Reversal

- Description: The Three White Soldiers pattern typically appears at the end of a downtrend or during a consolidation phase and signals the potential start of an uptrend. It consists of:

- First Candle: A bullish (green) candle.

- Second Candle: Another bullish candle, which opens within the previous candle’s body and closes near or above its high.

- Third Candle: A third bullish candle that closes higher than the previous two, showing continued strong buying pressure.

FAQs on Candlestick Patterns:

- What are candlestick patterns? Candlestick patterns is visual representations of price movements in stock markets, used in technical analysis to predict future price direction based on past behavior.

- What do the candlestick components represent? Each candlestick shows four key prices: the opening, closing, high, and low within a specific time period.

- What is the significance of candlestick colors? Typically, a green (or white) candlestick represents a price increase (bullish), while a red (or black) candlestick represents a price decrease (bearish).

- What are some common candlestick patterns? Popular patterns are Doji, Hammer, Shooting Star, Engulfing, and Morning/Evening Star.

- How are candlestick patterns used in trading? Traders use these patterns to identify potential reversals or continuations in trends, helping to make informed buy/sell decisions.

- What is a bullish candlestick pattern? A pattern indicating that the market might be heading upward, signaling potential buying opportunities.

- What is a bearish candlestick pattern? A pattern suggesting that the market may trend downward, signaling potential selling opportunities.

- Can candlestick patterns predict market movements accurately? While they offer insights, no pattern is 100% accurate. They are often used alongside other indicators for better trading decisions.

- How long does each candlestick cover? A candlestick can represent various time frames, from 1 minute to 1 month, depending on the chart setting.

- Are candlestick patterns useful in all markets? Yes, they are commonly used in stock, forex, and cryptocurrency markets