Here in this article we will checkout Garuda Construction IPO GMP, Subscription status, IPO important dates, quota details.

Company Overview

Garuda Construction and Engineering Ltd was established in 2010 and has since developed a strong foothold in the Indian construction sector. The company provides a diverse range of services, including residential, commercial, and infrastructure construction, alongside operation and maintenance (O&M) services and mechanical, electrical, and plumbing (MEP) work. Over the years, Garuda has built a strong reputation, completing several high-value projects that showcase its robust project management and execution capabilities.

The company’s promoter group includes individuals such as Pravin kumar Brijendra Kumar Agarwal, alongside corporate entities like PKH Ventures Ltd. Notably, Garuda’s recent projects highlight its emphasis on both quality construction and innovative infrastructure solutions, giving it a solid competitive edge in the industry.

Garuda Construction & Engineering IPO Overview

- IPO Issue Size: ₹264.10 crore

- Fresh Issue: ₹173.85 crore

- Offer for Sale (OFS): ₹90.25 crore

- Price Band: ₹92 to ₹95 per share

- Market Capitalization (based on upper price band): ₹883.5 crore

- Total Shares Offered: 2.78 crore shares, including 1.83 crore fresh equity shares and 95 lakh OFS shares

- Minimum Investment: 157 shares, equating to ₹14,915 at the upper price band

- Lead Manager: Corpwis Advisors Private Limited

- Registrar: Link Intime India Private Ltd

Garuda Construction IPO GMP

| Date | Grey Market Premium |

| 10 October 2024 | 5 |

| 9 October 2024 | 10 |

| 8 October 2024 | 22 |

| 6 October 2024 | 12 |

Garuda Construction IPO Subscription Status

As of today, the Garuda Construction and Engineering IPO has been subscribed 1.91 times, with strong interest from retail investors. The IPO has received bids for 3.80 crore shares compared to the 1.99 crore shares on offer. Retail Individual Investors (RIIs) have shown significant interest, with their portion subscribed 3.43 times, while non-institutional investors subscribed 1.10 times. However, Qualified Institutional Buyers (QIBs) have shown less interest, with only a 2% subscription rate so far.

Important Dates of the IPO

- IPO Opening Date: October 8, 2024

- IPO Closing Date: October 10, 2024

- Allotment Date: October 11, 2024

- Refund Initiation: October 14, 2024

- Credit of Shares to Demat Accounts: October 14, 2024

- Listing Date: October 15, 2024

Investors interested in this IPO must complete their applications and UPI mandate confirmations by 5:00 PM on October 10 to ensure smooth processing.

Quota Details

The allocation of shares for the Garuda Construction and Engineering IPO is structured across various categories:

- Qualified Institutional Buyers (QIBs): 50% of the net issue

- Non-Institutional Investors (NIIs): 15% of the net issue

- Retail Individual Investors (RIIs): 35% of the net issue

The minimum application lot for retail investors consists of 157 shares, and they can apply for a maximum of 13 lots, totaling 2041 shares. For high-net-worth individuals (HNIs), small investors need to apply for a minimum of 2,198 shares, while larger HNIs must apply for at least 10,676 shares. growth in revenue and assets over the past few years, reflecting the company’s ability to handle large-scale projects while maintaining healthy margins.

Garuda Construction IPO GMP Today – As of now grey market premium is zero.

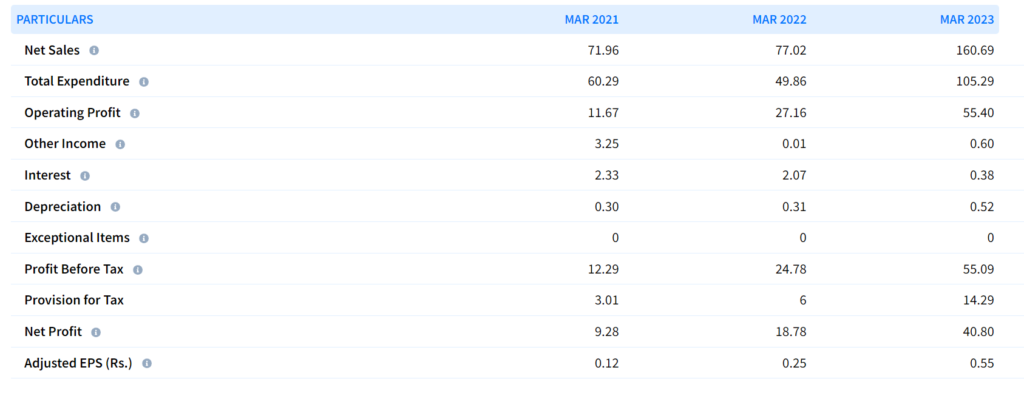

Company Financial

Future Outlook and Growth Potential

Garuda Construction and Engineering is well-positioned to capitalize on India’s burgeoning infrastructure development market. The company’s order book, valued at approximately ₹1,40,827.44 lakhs as of September 2024, consists of 12 ongoing projects, with seven of these having contract values exceeding ₹10,000 lakhs. This strong order book suggests sustained revenue generation for the foreseeable future.

Additionally, the company’s strategic focus on expanding into new geographical markets and diversifying its construction portfolio is expected to contribute to long-term growth. The Indian government’s push for infrastructure development, coupled with favorable policies such as production-linked incentive (PLI) schemes, further strengthens Garuda’s outlook.

Key Risks

One notable risk factor involves legal proceedings faced by one of the company’s promoters, Pravin kumar Agarwal. Additionally, the promoter group, PKH Ventures Ltd, had a previously unsuccessful IPO, which may cast some doubt on the company’s ability to generate investor interest. Nevertheless, these risks are mitigated by the company’s solid financials and expanding project portfolio.

Key Points Need to Consider Before Invest

When deciding to invest in an IPO, it’s essential to look beyond just the Grey Market Premium (GMP) and consider several key factors. Here’s a simplified breakdown:

1. Company Fundamentals

- Business Model & Market Position: Understand how the company makes money, its competitive edge, and how it stacks up in its industry.

- Revenue & Profitability: Check if the company is growing in terms of sales and profits. Look at profit margins to gauge efficiency.

- Debt Levels: Be cautious if the company has a lot of debt. Check the debt-to-equity ratio and how well the company manages its cash flow.

- Future Growth Prospects: Assess the company’s plans for growth, like new products or expanding into new markets. Are these plans realistic and sustainable?

2. Management & Promoters

- Promoter Background: Investigate the promoters’ experience and track record in managing companies. Look out for any negative news or legal issues.

- Corporate Governance: Ensure the company has strong governance, with transparency and ethical management practices.

3. IPO Valuation

- P/E Ratio: Compare the company’s Price-to-Earnings ratio with competitors to see if the IPO is fairly priced or overvalued.

- Issue Price: Check if the price band of the IPO is reasonable, considering the company’s financial health and future potential.

- Market Sentiment: Consider the overall market mood—whether it’s bullish or bearish—as it can influence the IPO’s performance.

4. Grey Market Premium (GMP)

- What is GMP?: GMP shows the price shares are trading for in the unofficial market before listing. A high GMP often indicates strong demand.

- GMP Fluctuations: Keep in mind that GMP can change quickly and might not always reflect the company’s fundamentals. It’s a helpful signal but should not be your only consideration.

5. Subscription Details

- Investor Segments: Look at how various investor categories (like Retail, Qualified Institutional Buyers, Non-Institutional Investors) are subscribing. High interest from institutional investors is a good sign.

- Oversubscription: A highly oversubscribed IPO indicates strong demand but might lower the chances of retail investors getting allotment.

6. Lock-in Period

- Promoter Lock-in: Promoters are often restricted from selling their shares for a certain period after the IPO. While this adds stability, it also limits liquidity initially.

7. Risks

- Sector Risks: Consider any risks specific to the industry, such as regulatory changes, competition, or fluctuating raw material costs.

- Geopolitical & Economic Risks: Global factors, like trade policies or currency fluctuations, can affect a company’s performance, especially for businesses that rely on imports or exports.

8. Brokerage Reviews

- Analyst Ratings: See what experts from brokerage firms are saying about the IPO. Their insights can provide valuable guidance.

- Buy/Sell Recommendations: Many brokerages offer recommendations on whether to subscribe to or avoid the IPO based on their analysis.