Sagility India, a healthcare services leader, received a strong response from the investment community. The IPO was oversubscribed 3.52 times, reflecting confidence in the company’s business model and growth potential. now shares allotement will be on 8th November, You can check the sagility india ipo allotment status on Link Intime’s official IPO allotment page or on BSE’s allotment status page by entering your PAN, application number, or DP ID/client ID.

| Table Of Content |

|---|

| Methods to Check the Allotment Status |

| Sagility India IPO GMP Trend |

| Sagility India IPO Listing Date |

| Top FAQs |

Methods to Check the Sagility India IPO Allotment Status

Once the allotment for the Sagility India IPO is finalized, you can follow these methods to check if you’ve received any shares or not.

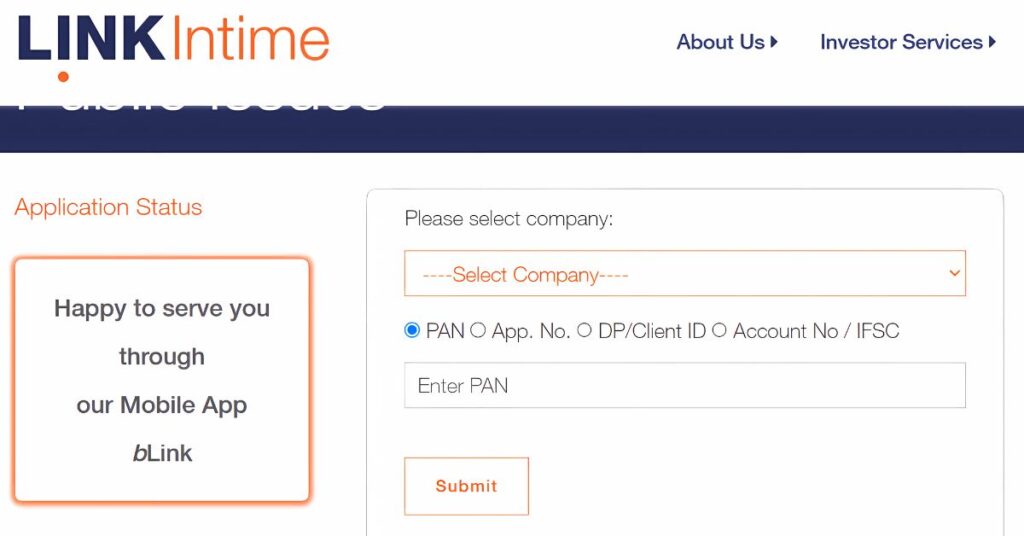

Methods 1: Link Intime’s Website

- Go to the Link Intime IPO allotment page

- Link – https://linkintime.co.in/initial_offer/public-issues.html

- From the dropdown menu, select “Sagility India Limited IPO”.

- Enter your details using one of the following options:

- Application Number

- PAN

- DP Client ID

- Click on “Search” to view your allotment status.

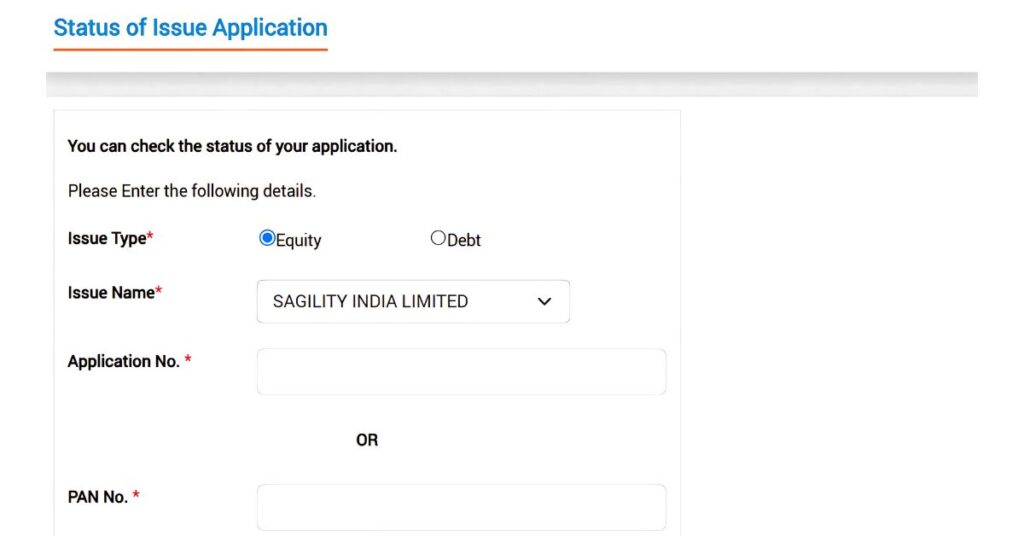

Methods 2: BSE Website

- Visit the BSE Allotment Page.

- Link – https://www.bseindia.com/investors/appli_check.aspx

- In the Company field, enter “Sagility India”.

- Provide the required application details.

- Click on “Search” to check your allotment status.

Following either of these methods will help you quickly confirm if you’ve been allotted shares in the IPO.

Sagility India IPO GMP Trend

The Grey Market Premium (GMP) gives a snapshot of investor sentiment and potential listing gains. Here’s how Sagility India’s GMP has varied in recent days:

| Date | GMP (₹) |

|---|---|

| 2 November | ₹2.5 |

| 3 November | ₹2.0 |

| 4 November | ₹3.0 |

| 5 November | ₹3.5 |

| 6 November | ₹2.5 |

This trend suggests a positive outlook, though final listing prices depend on market dynamics as the listing date nears

Sagility India IPO Listing Date

Mark these important dates in your calendar

| Event | Date |

|---|---|

| Allotment Date | November 8, 2024 |

| Refund Initiation | November 9, 2024 |

| Shares in Demat | November 10, 2024 |

| Listing Date | November 12, 2024 |

These dates ensure investors know when to expect either a share credit or refund.

Expected Listing Gains

Based on GMP, Sagility India shares could list slightly above the issue price, with expected gains around ₹2-₹3 per share. Although the final price will depend on broader market conditions, investors may see a modest premium upon listing, hinting at a listing price between ₹32-₹33 per share.

What Investors Should Consider Before Listing

To maximize potential returns on listing day, consider these tips:

- Watch GMP Trends: Keeping an eye on GMP as the listing day approaches can provide a real-time gauge of market enthusiasm.

- Set a Selling Strategy: If you’re allotted shares, decide whether to hold for long-term gains or to sell early based on listing-day sentiment.

- Review Market Conditions: Broader market performance can significantly influence the IPO’s debut price. Stay informed on major market movements that might affect listing outcomes.

Top FAQs

- What is the issue size of Sagility India IPO?

- The Sagility India IPO has an issue size of approximately ₹1,600 crore.

- What is the price band and lot size for Sagility India IPO?

- The price band for the IPO is ₹28 – ₹30 per share, and the minimum lot size is 500 shares.

- How can I check the allotment status of Sagility India IPO?

- You can check the allotment status on Link Intime’s official IPO allotment page or on BSE’s allotment status page by entering your PAN, application number, or DP ID/client ID.

- What is the GMP (Grey Market Premium) trend for Sagility India IPO?

- The GMP for the Sagility IPO has ranged between ₹2 and ₹3.5 in the last few days, indicating moderate demand.

- What are the expected listing gains for Sagility India IPO?

- Based on current GMP, the IPO may see listing gains around 7-10%, but actual gains will depend on market conditions at the time of listing.

- How many times was Sagility India IPO subscribed?

- The IPO was subscribed approximately 3.52 times overall on the final subscription day.

- Are there any risks associated with investing in Sagility India IPO?

- As with all IPOs, risks include market volatility, sector-specific challenges in healthcare, and potential changes in investor sentiment post-listing.