Intraday trading can be an exciting way to grow your portfolio, especially if you understand the basics and stick to sound intraday trading strategies. Whether using moving averages, support and resistance levels, or chart patterns, the right approach and mindset can make a difference in your success.

What Is Intraday Trading?

Intraday trading, often called day trading, is a trading style where buying and selling occur within the same trading day. The goal is to capitalize on small price fluctuations to make a profit quickly. Unlike long-term investors, intraday traders don’t hold onto stocks overnight. Instead, they focus on intraday trading strategies to seize short-term gains within the day.

Whether you’re a beginner or seasoned trader, understanding the basics and having a solid plan are key to successful intraday trading. Here, we’ll walk you through the essential Best intraday trading strategies for beginners, the best trading times, and practical intraday trading tips to help you make smart trades today.

Best Intraday Trading Strategies For Beginners

Effective intraday trading strategies are critical for staying profitable and managing risks. Here are some beginner-friendly strategies that can help guide your intraday trades.

Moving Average Intraday Trading Strategy

Moving averages (MAs) help smooth out price data to reveal trends and make sense of price movements over time. By using multiple time frames, intraday traders can find optimal entry and exit points.

- Simple Moving Average (SMA): This average uses the stock price over a specific period, like 5 or 10 minutes. Short-term SMAs can show immediate trends, while longer SMAs (like a 50-period) give a broader trend view. When price takes support at 50/200 SMA otr it breaks 50/200 SMA, this could be a buying entry point.

- Exponential Moving Average (EMA): EMA puts more emphasis on recent prices, making it especially useful in fast-moving markets. For example, a crossover between a 9-period and 21-period EMA might signal the start of a trend, creating buying or selling opportunities.

- Using Multiple Time Frames: Many traders check different time frames, like 5-minute and 15-minute charts, to confirm trends and choose the best times to enter or exit trades.

2.Support And Resistance Intraday Trading Strategy

Support and resistance are key price levels where a stock tends to find demand (support) or supply (resistance). Knowing how to identify and use these levels is essential in intraday trading.

- Breakout Trading: When the stock price breaks through resistance or falls below support, it often indicates a strong move in that direction. For instance, if a stock breaks above its resistance level, it may mean a new uptrend is beginning.

- Range Trading: In this strategy, traders buy at support and sell at resistance when a stock moves in a defined range. This can be especially useful in stable markets where prices move predictably between levels.

- Pivot Points: Calculated from the previous day’s prices, pivot points can indicate potential support and resistance levels for intraday trading. Traders use these levels to gauge entry and exit points for a smoother trade experience.

3.Indicator Based Trading Stratergy

Technical indicators are powerful tools for intraday trading as they help reveal trends and potential reversals. Here are the top three indicators that beginners can start with:

- Relative Strength Index (RSI): RSI tells you if a stock is overbought or oversold. An RSI above 70 often indicates an overbought stock (good for selling), while below 30 indicates oversold conditions (good for buying).

- Moving Average Convergence Divergence (MACD): MACD measures momentum and indicates trend direction. If the MACD line crosses above the signal line, it’s a sign to buy; if it crosses below, it’s a signal to sell.

- Bollinger Bands: Bollinger Bands are plotted around a moving average to show potential overbought or oversold levels. When the price hits the upper band, it could signal an overbought condition, and touching the lower band might mean oversold conditions.

4. Chart Patterns and Candlestick Based Stratergy

Chart patterns and candlestick formations reveal important market sentiment, which helps predict price trends.

- Head and Shoulders Pattern: This classic pattern signals a reversal trend. When seen at the end of an uptrend, it might indicate a bearish reversal, while an inverse head and shoulders can signal a bullish reversal.

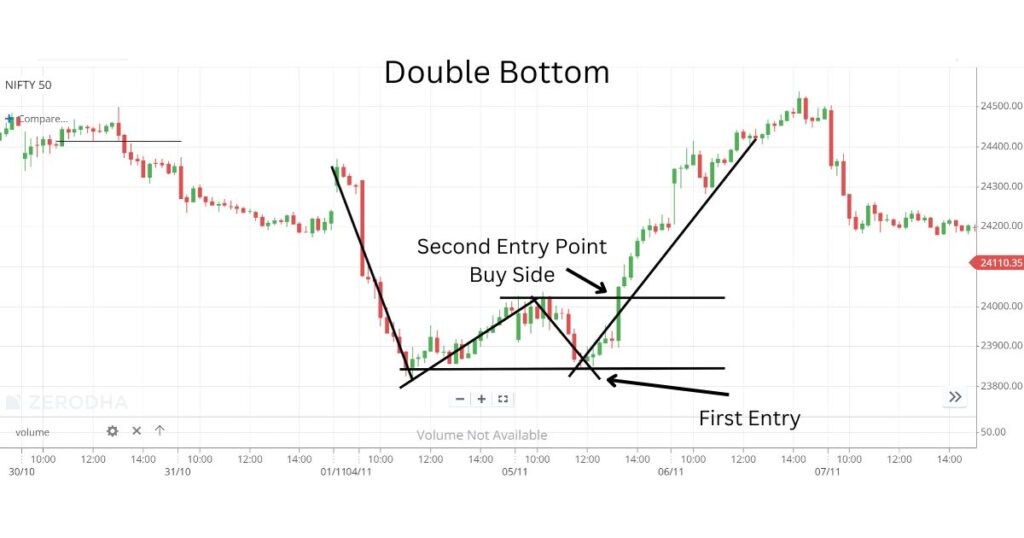

- Double Top and Double Bottom Patterns: Double top indicates a bearish reversal, while a double bottom often signals a bullish reversal. These patterns are ideal for finding profitable entry and exit points.

- Candlestick Patterns: Candlestick patterns, such as the Hammer, Doji, and Engulfing patterns, can reveal changes in price direction:

- A Hammer at the end of a downtrend may indicate a bullish reversal.

- A Bullish Engulfing pattern occurs when a green candle engulfs a previous red candle, indicating strong buying interest.

Best Intraday Trading Time

Timing is everything in intraday trading. The market moves differently throughout the day, and each period offers unique opportunities.

- Opening Hours (9:15 AM – 10:30 AM): The first hour is highly volatile as the market reacts to overnight news and reports. This can be an ideal time for experienced traders who know how to navigate quick price changes.

- Mid-Day (11:30 AM – 2:30 PM): During these hours, the market often stabilizes, with less extreme price movement. Beginners may find this period easier to trade as trends are clearer and less volatile.

- Closing Hours (2:30 PM – 3:30 PM): The last hour of trading can be very active, as traders close their positions for the day. This final push can provide good opportunities for experienced intraday traders.

Tips For Intraday Trading

For beginners, managing risk and understanding the fundamentals of intraday trading are critical. Here are some intraday trading tips for today:

- Set a Stop-Loss: Always place a stop-loss to protect your capital and limit potential losses.

- Avoid Overtrading: Focus on high-probability trades rather than trading excessively.

- Stay Updated on News: News can move markets quickly. Staying informed allows you to anticipate sudden price changes and adjust your trades.

- Trade Liquid Stocks: Stocks with high liquidity allow for easier entry and exit, which is vital for intraday trading.

Risks of Intraday Trading

While intraday trading strategies for beginners offer potential profits, they also come with risks. Understanding these risks can help you trade more confidently and avoid unnecessary losses.

- Market Volatility: Intraday trading relies on short-term price movement, which can lead to large losses if the market turns unexpectedly.

- Leverage Risk: Many traders use leverage, but while it can increase profits, it also magnifies losses.

- Emotional Stress: Monitoring the market continuously can lead to impulsive decisions based on fear or greed.

Difference Between Intraday and Swing Trading

While both intraday trading and swing trading focus on shorter timeframes than traditional investing, they are different approaches:

- Holding Period: Intraday traders buy and sell within the same day, while swing traders may hold stocks for several days or weeks.

- Strategy Focus: Intraday trading relies heavily on fast signals and indicators, while swing trading combines technical analysis with a focus on longer-term market trends.

- Risk Level: Swing trading allows more time for trades to play out but involves overnight risk, while intraday trading avoids overnight exposure but requires frequent trades.

Final Thoughts

Intraday trading can be an exciting way to grow your portfolio, especially if you understand the basics and stick to sound intraday trading strategies. Whether using moving averages, support and resistance levels, or chart patterns, the right approach and mindset can make a difference in your success.

Remember to keep risk management a priority and start with intraday trading strategies for beginners before moving to more complex trades. With time and practice, you’ll be better equipped to make confident decisions and achieve your trading goals.

best intraday trading strategies wikipedia

FAQs

What is intraday trading?

Intraday trading involves buying and selling stocks on the same day to capitalize on price movements.

Which indicators are best for intraday trading?

Popular indicators include Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

How does support and resistance work in intraday trading?

Support and resistance levels help traders identify potential entry and exit points based on stock price patterns.

What are some common intraday strategies?

Common strategies include scalping, trend-following, and breakout trading.

How to set a stop-loss in intraday trading?

Stop-loss is set slightly below support levels or based on a fixed percentage of capital risk.

What is the difference between intraday and swing trading?

Intraday is for same-day trades, while swing trading spans several days to weeks based on medium-term trends.

How much capital is needed for intraday trading?

The capital requirement varies but should be enough to cover potential losses; most brokers also offer margin for intraday trades.