1. History of PN Gadgil Jewellers IPO

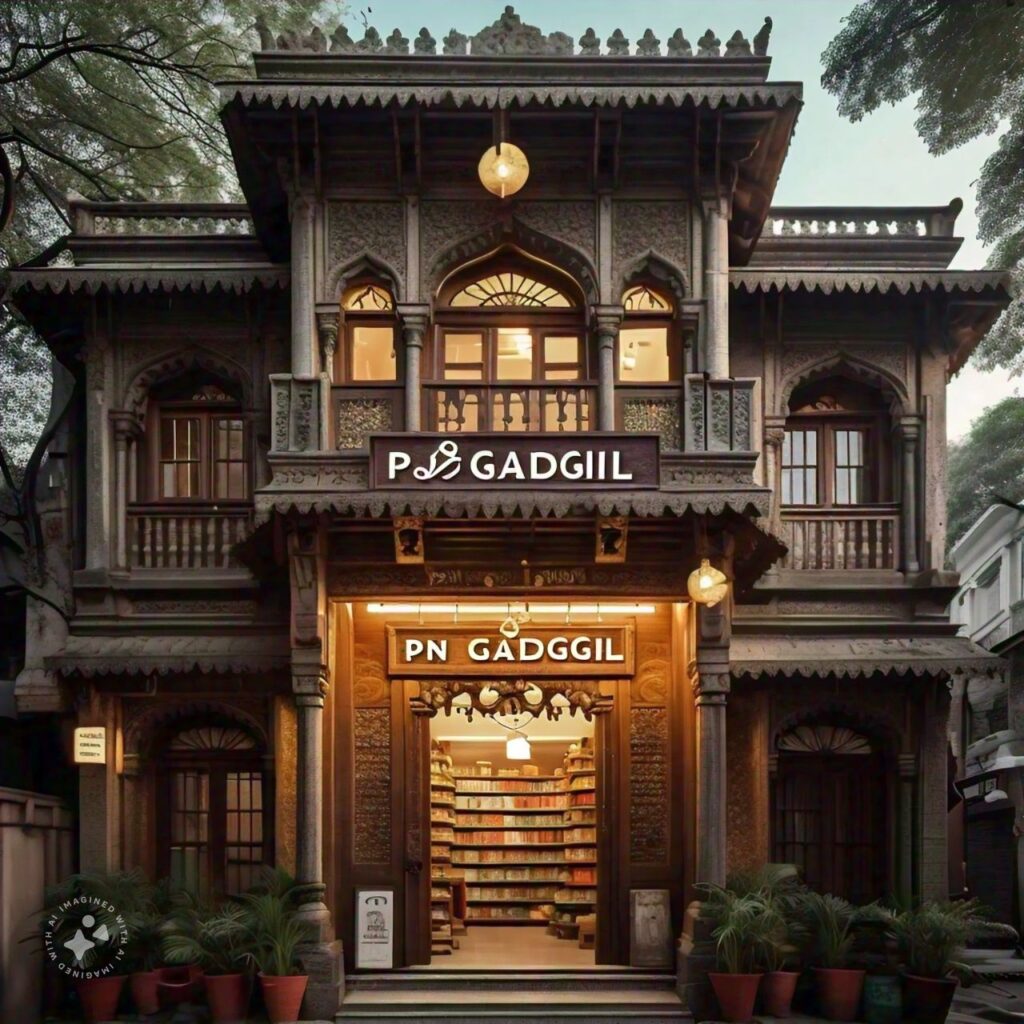

PN Gadgil Jewellers, established in 1832, is one of the oldest and most renowned names in India’s jewelry industry. Known for its quality craftsmanship and heritage, the company has built a strong legacy over nearly two centuries. Initially starting as a small jewelry shop in Sangli, Maharashtra, PN Gadgil has expanded its operations, now boasting 39 stores across Maharashtra and Goa, with a wide range of offerings, including gold, diamond, and platinum jewelry. The brand is especially popular for its traditional Maharashtrian jewelry, attracting customers from all over India.

The company is well-regarded for its ability to blend traditional jewelry designs with contemporary trends, catering to various customer demographics. Its stronghold in Maharashtra has paved the way for further expansion into Tier II and Tier III cities. PN Gadgil’s focus on customer satisfaction, trust, and innovation has allowed it to maintain a loyal customer base for generations.

2. PN Gadgil Jewellers IPO Highlights :

PN Gadgil Jewellers launched its Initial Public Offering (IPO) in September 2024. The company aims to raise ₹1,100 crore through a combination of fresh issues and offers for sale (OFS). Here are the key details:

- IPO Size: ₹1,100 crore

- Fresh Issue: ₹850 crore

- Offer for Sale: ₹250 crore

- IPO Price Band: ₹456 to ₹480 per share

- Lot Size: 30 shares

- Listing Exchange: NSE and BSE

- Objective:

- The proceeds will be used to fund the expansion of new stores in Maharashtra and Goa.

- Part of the funds will be used to repay existing borrowings and for general corporate purposes.

The company plans to open 12 new stores in under-served markets in Maharashtra and increase its digital presence through e-commerce platforms. This expansion is expected to improve its market share and revenue growth.

3. IPO Grey Market Premium (GMP)

As of mid-September 2024, the IPO has seen strong interest from investors, with a Grey Market Premium (GMP) of around ₹315 per share. This suggests that the stock could see a substantial listing gain on its debut. Investors are optimistic due to PN Gadgil’s solid financial track record, strong brand recognition, and growth potential.

The attractive GMP indicates that many investors are expecting high demand for the stock on listing day, which could drive up its price significantly.

4. Post Listing Strategy

PN Gadgil Jewellers presents a promising investment for both short-term and long-term investors. Here’s a breakdown of the strategy post-listing:

For Short-Term Investors:

Given the strong Grey Market Premium and demand for the IPO, short-term investors may consider booking listing gains. If the stock lists at a premium, selling on listing day could provide substantial profits. However, short-term investors should also keep an eye on market sentiment and demand fluctuations as these could impact the post-listing price.

For Long-Term Investors:

PN Gadgil Jewellers offers a solid long-term investment opportunity due to its strong fundamentals, consistent growth, and expansion plans. The company is expanding aggressively in Tier II and Tier III cities, which will help it tap into new markets and drive future revenue. Furthermore, the jewelry industry is expected to grow steadily, driven by increasing disposable incomes, especially in semi-urban and rural areas.

Additionally, PN Gadgil has a strong brand reputation and a loyal customer base, which will continue to contribute to its growth. Its focus on modernizing its operations through digital platforms and its expansion into underserved regions positions the company well for long-term success.

Risks to Consider:

Despite its strengths, PN Gadgil faces some risks, including heavy dependence on Maharashtra for a large portion of its revenue. Any disruption in the region—whether economic, regulatory, or competitive—could impact the company’s financial performance. Additionally, the jewelry industry is highly competitive, with players like Kalyan Jewellers and Titan posing significant competition.

Investors should also be aware of market volatility, which could affect the stock’s price post-listing.

5. Conclusion

PN Gadgil Jewellers has demonstrated solid financial performance over the last four quarters, with strong growth in revenue, net profit, and margins. Its IPO presents a lucrative opportunity for both short-term and long-term investors. While short-term investors could benefit from listing gains, long-term investors stand to gain from the company’s expansion plans and continued growth.

With a strong brand legacy, innovative product offerings, and strategic expansion, PN Gadgil Jewellers is well-positioned to grow in the highly competitive jewelry market. Investors should carefully evaluate their risk tolerance and investment horizon before making a decision.

Pingback: Ongoing and Upcoming IPOs in India: September 2024 Insights

Pingback: What Is IPO? Understanding Initial Public Offerings Explained